Indicators on Feie Calculator You Need To Know

Table of ContentsThe Main Principles Of Feie Calculator Feie Calculator Can Be Fun For Anyone8 Simple Techniques For Feie CalculatorThe Best Strategy To Use For Feie CalculatorThe smart Trick of Feie Calculator That Nobody is Discussing

He sold his U.S. home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his partner to help fulfill the Bona Fide Residency Examination. Neil aims out that purchasing residential or commercial property abroad can be challenging without initial experiencing the place."It's something that individuals need to be actually attentive regarding," he claims, and recommends deportees to be careful of usual blunders, such as overstaying in the U.S.

Neil is careful to stress to Tension tax united state tax obligation "I'm not conducting any carrying out any kind of Organization. The United state is one of the few countries that taxes its residents no matter of where they live, suggesting that also if an expat has no income from United state

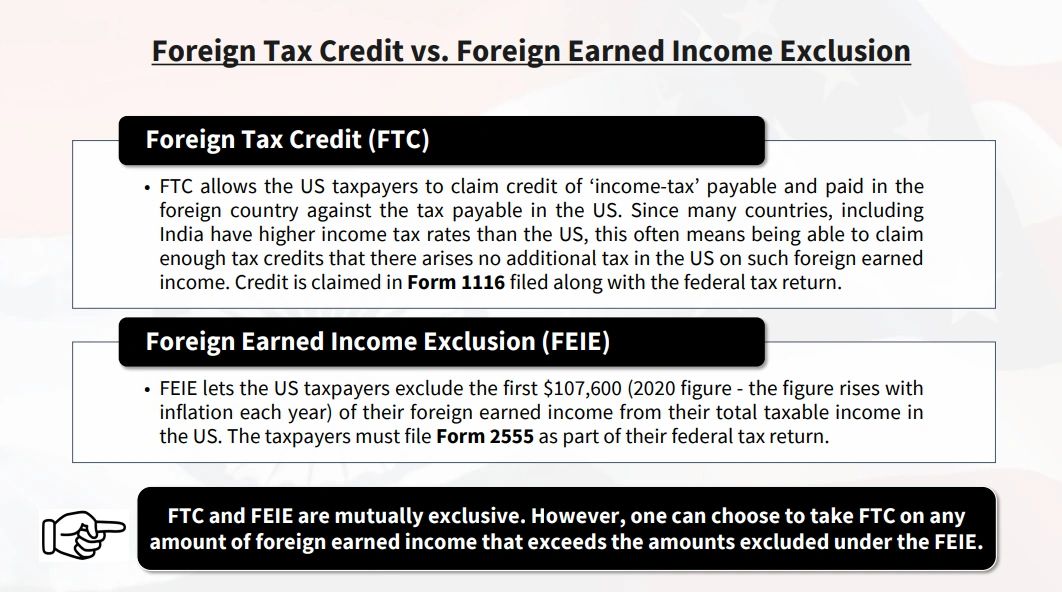

tax return. "The Foreign Tax obligation Credit score allows people functioning in high-tax countries like the UK to offset their U.S. tax obligation responsibility by the amount they've already paid in tax obligations abroad," says Lewis.

The Feie Calculator PDFs

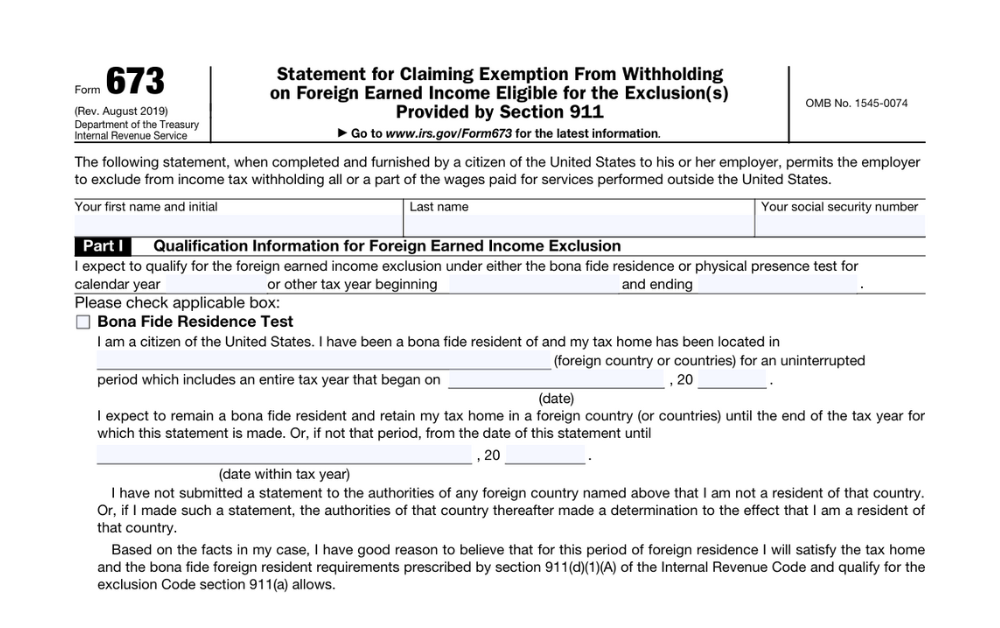

Below are several of one of the most often asked concerns concerning the FEIE and other exemptions The Foreign Earned Income Exclusion (FEIE) enables united state taxpayers to exclude approximately $130,000 of foreign-earned income from federal income tax, reducing their united state tax obligation. To certify for FEIE, you must fulfill either the Physical Existence Test (330 days abroad) or the Authentic Home Examination (verify your key residence in an international nation for a whole tax obligation year).

The Physical Existence Examination requires you to be outside the united state for 330 days within a 12-month period. The Physical Visibility Test also requires united state taxpayers to have both an international revenue and a foreign tax obligation home. A tax home is defined as your prime place for company or work, no matter your household's home.

Fascination About Feie Calculator

An income tax treaty in between the U.S. and one more nation can assist avoid double tax. While the Foreign Earned Income Exclusion decreases taxable revenue, a treaty may offer fringe benefits for eligible taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a needed declare U.S. citizens with over $10,000 in foreign economic accounts.

Eligibility for FEIE depends upon conference details residency or physical visibility tests. is a tax obligation expert on the Harness system and the founder of Chessis Tax. Clicking Here He is a member of the National Association of Enrolled Professionals, the Texas Society of Enrolled Agents, and the Texas Society of CPAs. He brings over a decade of experience helping Huge 4 companies, encouraging migrants and high-net-worth people.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax expert on the Harness platform and the founder of The Tax Man. He has over thirty years of experience and now specializes in CFO services, equity settlement, copyright taxes, marijuana taxes and separation related tax/financial preparation issues. He is an expat based in Mexico - https://lizard-mechanic-776.notion.site/Foreign-Earned-Income-Exclusion-How-Digital-Nomads-and-American-Expats-Can-Ditch-the-Tax-Burden-240d0ece9741801892a2f0b3d5101c89?source=copy_link.

The international earned revenue exemptions, occasionally described as the Sec. 911 exclusions, leave out tax on wages earned from functioning abroad. The exclusions make up 2 components - an earnings exclusion and a real estate exclusion. The adhering to FAQs discuss the advantage of the exemptions including when both partners are expats in a basic manner.

Top Guidelines Of Feie Calculator

The tax benefit excludes the income from tax at lower tax obligation rates. Previously, the exemptions "came off the top" reducing income subject to tax obligation at the top tax prices.

These exemptions do not excuse the earnings from US taxes but just give a tax obligation decrease. Note that a solitary individual functioning abroad for all of 2025 who gained concerning $145,000 without various other revenue will have taxable revenue lowered to zero - effectively the very same solution as being "free of tax." The exclusions are computed daily.